Or small places that work well for a couple who are just too damn lazy to clean up to go out to dinner after a day of skiing. We may resemble that remark.

-

For more information on how to avoid pop-up ads and still support SkiTalk click HERE.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Non Region Specific Ski Town Real Estate

- Thread starter newfydog

- Start date

that’s what Door Dash is for…Or small places that work well for a couple who are just too damn lazy to clean up to go out to dinner after a day of skiing. We may resemble that remark.

or Poor Dash (aka getting take out yourself) if you’re me.

In a lot of cases the nightly rates for small groups are markedly cheaper and don’t come with checklists of chores. It’s another reason for the backlash.Yep.

I inderstand the backlash. But wait until they see the nightly rates for hotels with lodgers taxes and fees. At least in mountain towns where everyone is struggling to secure cleaning staff. Add meals out and it is still more expensive than airbnb, especially for groups or families who need more than one bedroom.

Hotel stays make sense if you are only staying for a few days. Cleaning fees amortized over a week are not as bad as if you stay for a weekend. And a few days may not be enough time to get claustrophobic in a motel room eating take out with a plastic fork while sitting on your bed.

I can't eat take out or fast food or restaurant food for more than a couple of meals in a week. It makes me feel sick. If I buy lunch skiing, I stick to salad or soup if I'm doing it more than one day. Restaurant food will ruin a vacation for me. The few times, I've traveled where I had to eat restaurant food was cruises or all inclusive vacations and I'm very, very careful! I won't stay someplace that doesn't have a kitchen.

I for one hope there is general purge of shady/subpar/lazy/corporate AirBnb listings. When it first started it was a great way to actually live sort of like a local. But ofc once corporations realized there was money to be made (and scammed), in many places it's just another hotel but without the health inspections...I suspect the best listings and hosts will do just fine even in a downturn, although they might have to cut prices. The "cleaning fees" are both painful and insulting in many cases.

No, I am one of those people at this point;-)Why is it sad that people may be able to hold on to their houses through a market downturn?

You’re rooting for them to lose their houses?

- Joined

- Jul 3, 2016

- Posts

- 1,896

@Jerez it is interesting that they even have an article in New Zealand about the slowdown in AirBnB bookings in the US. It is an interesting read.

'No bookings at all': Airbnb hosts panic as guests slam cleaning fees and 'chores lists'

Is the era of Airbnb coming to an end?www.nzherald.co.nz

And the articles keep on coming. I've read several on Apple News.

Apparently

"Too Many Rich People Bought Airbnbs. Now They’re Sitting Empty"

Why Airbnbs Are Getting Harder to Rent Out

Many Airbnb hosts are weathering a decline in renters, after a pandemic boom, because of these factors

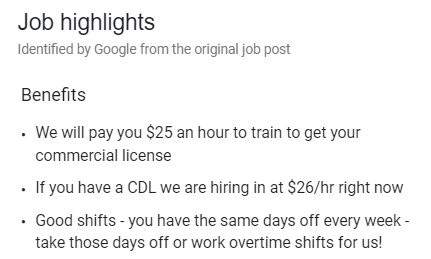

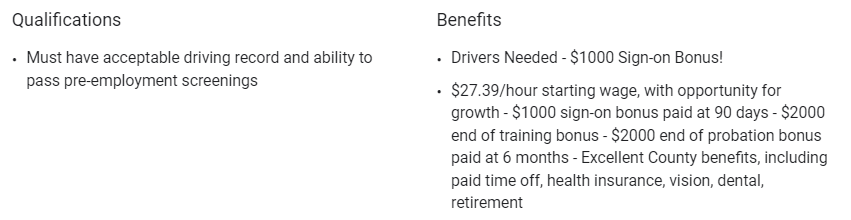

It's tough to live in Summit County for snow plow drivers starting at $20/hour, so even CDOT is looking at building workforce housing.

A Park City realtor friend corroborated today what I’ve been hearing from other brokers. Plenty of buyers circling but reticent to act given uncertainty over where things are going. Sellers backing off on list price but not so much on expected price. The pricing drops which have been reported are list price so not all that meaningful. Yet. So a low to no activity bid ask spread environment.

Sellers think it is still 2021, buyers already see it as 2023…..A Park City realtor friend corroborated today what I’ve been hearing from other brokers. Plenty of buyers circling but reticent to act given uncertainty over where things are going. Sellers backing off on list price but not so much on expected price. The pricing drops which have been reported are list price so not all that meaningful. Yet. So a low to no activity bid ask spread environment.

Isn't there typically a standoff like this before prices really correct downwards though? Doesn't it take a while before sellers capitulate on price or are you seeing something about current conditions different than the usual lull before the drop? While the market has clearly peaked i honestly expected more of a drop by now. I might be too negative where things are headed. A bunch of data points lead me to believe we have probably just entered into a recession.A Park City realtor friend corroborated today what I’ve been hearing from other brokers. Plenty of buyers circling but reticent to act given uncertainty over where things are going. Sellers backing off on list price but not so much on expected price. The pricing drops which have been reported are list price so not all that meaningful. Yet. So a low to no activity bid ask spread environment.

Yes. I see it as a question as to what extent employment will be affected. So far very little. But the longer tightening goes on the more we should begin to see job losses which which would be a trigger, exacerbated by interest rates. My opinion is the Fed won’t stop until there’s a meaningful dip in employment. So I expect prices to move beyond what we have right now which is mostly a bid ask spread.Isn't there typically a standoff like this before prices really correct downwards though? Doesn't it take a while before sellers capitulate on price or are you seeing something about current conditions different than the usual lull before the drop? While the market has clearly peaked i honestly expected more of a drop by now. I might be too negative where things are headed. A bunch of data points lead me to believe we have probably just entered into a recession.

Looks like a similar story in the Denver Metro market as outlined in this Denver Post article today.

That tug of war between reduced demand and lower supply caused the inventory of active listings, which had been rising sharply this summer, to reverse course. There were 7,290 homes and condos listed for sale at the end of October, down 5.1% from the number listed at the end of September.

Over the past 12 months, the number of listings is up 116%, which seems like a huge increase, but it comes off very low levels. Even after more than doubling the past year, the number of listings is still under half of the historical average for October of 14,597 in tallies going back to 1985. And the supply hasn’t reached pre-pandemic levels of the 8,557 listings available in October 2019.

“While our market changes, the point that has been largely overlooked is that the last two years have been the exception and certainly not the rule. If we were to remove 2020 and 2021 from the record books, our market trajectory is on pace with where it should be had COVID-19 not happened,” said Libby-Levinson-Katz, chairwoman of the DMAR Market Trends Committee and a Denver Realtor.

Home prices were the most noticeable things to go whacky since the summer of 2020. But they are falling back to earth fast. The median price for a single-family home fell 1.2 percent between September and October to $622,490. For the year it is still up 6.5%. The median closing price of condos and townhomes fell 1.22% to $405,000 on the month and remains up 8% on the year.

The number of days that listings spend on the market before going under contract also continues to rise. The average for single-family homes is now 29 days, while for condos and townhomes it is 25 days. It took three times as long to find a buyer for a listing in October than it did in May.

Levinson-Katz said sellers may be waiting to list during the peak home-buying season this spring. But she cautioned that some buyers are still active and trying to lock in something before mortgage rates move even higher. For buyer and seller alike, conditions are likely to be more favorable now than six months from now.

www.denverpost.com

www.denverpost.com

Buyers are pulling back hard in metro Denver housing market, but so are sellers

Inventory still fell despite a nearly 25% decline in closings in October

Nearly a quarter fewer homes and condos sold in October than in September as higher mortgage rates sidelined more buyers. But sellers also went on strike, putting only three-quarters as many homes on the market as they did in September, according to a monthly update Thursday from the Denver Metro Association of Realtors.That tug of war between reduced demand and lower supply caused the inventory of active listings, which had been rising sharply this summer, to reverse course. There were 7,290 homes and condos listed for sale at the end of October, down 5.1% from the number listed at the end of September.

Over the past 12 months, the number of listings is up 116%, which seems like a huge increase, but it comes off very low levels. Even after more than doubling the past year, the number of listings is still under half of the historical average for October of 14,597 in tallies going back to 1985. And the supply hasn’t reached pre-pandemic levels of the 8,557 listings available in October 2019.

“While our market changes, the point that has been largely overlooked is that the last two years have been the exception and certainly not the rule. If we were to remove 2020 and 2021 from the record books, our market trajectory is on pace with where it should be had COVID-19 not happened,” said Libby-Levinson-Katz, chairwoman of the DMAR Market Trends Committee and a Denver Realtor.

Home prices were the most noticeable things to go whacky since the summer of 2020. But they are falling back to earth fast. The median price for a single-family home fell 1.2 percent between September and October to $622,490. For the year it is still up 6.5%. The median closing price of condos and townhomes fell 1.22% to $405,000 on the month and remains up 8% on the year.

The number of days that listings spend on the market before going under contract also continues to rise. The average for single-family homes is now 29 days, while for condos and townhomes it is 25 days. It took three times as long to find a buyer for a listing in October than it did in May.

Levinson-Katz said sellers may be waiting to list during the peak home-buying season this spring. But she cautioned that some buyers are still active and trying to lock in something before mortgage rates move even higher. For buyer and seller alike, conditions are likely to be more favorable now than six months from now.

Buyers are pulling back hard in metro Denver housing market, but so are sellers

Nearly a quarter fewer homes and condos sold in October than in September as high mortgage rates sidelined more buyers. But sellers also went on strike, putting only three-quarters as many homes on…

www.denverpost.com

www.denverpost.com

You are right that so far employment hasn't been affected much. But you're now starting to see some tech firms laying people off for the first time in a while. Big tech like Intel, etc and some social media companies. Amazon is hitting the brakes. Might be the canary in the coal mine for general employment trends. And there is often a 6 month lag on when the interest rate hikes filter through the economy. Who knows though. I might be too negative and we do get a smooth landing.Yes. I see it as a question as to what extent employment will be affected. So far very little.

Was about ready to post the same thoughts …You are right that so far employment hasn't been affected much. But you're now starting to see some tech firms laying people off for the first time in a while. Big tech like Intel, etc and some social media companies. Amazon is hitting the brakes. Might be the canary in the coal mine for general employment trends. And there is often a 6 month lag on when the interest rate hikes filter through the economy. Who knows though. I might be too negative and we do get a smooth landing.

Big Tech hitting the brakes big time on hiring. And for ski town real estate pricing, general employment doesn’t matter, employment in tech, law, consulting, finance, real estate, etc. does.

Lots of big tech companies starting to adopt the Jack Welch model of fire the lowest 20% each year. For Elon, 50% apparently. Unheard of recently, where the biggest worry was hiring enough workers. Meta/FB a prime example. Bad strategic bets get penalized in a non-crazy growth period.

Given this current leverage, lots of CEOs pushing return to office and hybrid. Tough to live in Bozeman when you have to be in city X 2-3 days a week. Interesting thing is city X not necessarily SF, NYC, DC, CHC anymore.

'Cause Jack Welch's model worked so well for GE long term....

The PE funds all got spooked in the spring and did layoffs in June/July. Kinda surprised I haven’t heard about more cuts sooner since then. Who knows what other cuts are in store.You are right that so far employment hasn't been affected much. But you're now starting to see some tech firms laying people off for the first time in a while. Big tech like Intel, etc and some social media companies. Amazon is hitting the brakes. Might be the canary in the coal mine for general employment trends. And there is often a 6 month lag on when the interest rate hikes filter through the economy. Who knows though. I might be too negative and we do get a smooth landing.

Sponsor

Staff online

-

PhilpugNotorious P.U.G.

Members online

- surfski

- BullMcCabe

- JibingDownhill

- François Pugh

- SkiOAP

- xiskiguy

- Rich McP

- Laurel Hill Crazie

- scvaughn

- Nomax

- deadheadskier

- Scruffy

- ANOpax

- BeiJiHu

- HalB

- Miker

- Philpug

- Matt Merritt

- aveski

- GB_Ski

- Truberski

- Yepow

- Wade

- pipestem

- wooglin

- Fuller

- mikes781

- JustSkidding

- sparty

- Peakviper

- klemm3258

- MissySki

- butleri

- my07mcx2

- graham418

- Old Runner Frank

- PupManS

- jetwolverine

- JCF

- geepers

- RickH

- SpeedyKevin

- AUdicky

Total: 2,602 (members: 53, guests: 1,876,robots: 673)