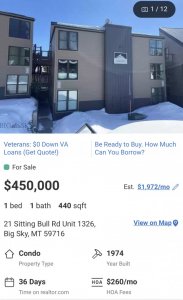

Location matters a lot. I gave up on the idea of home ownership when I was living in Vermont; the places I could have afforded were too far from the skiing and the jobs I was interested in.It seems like the good ole version of the American dream is officially dead.

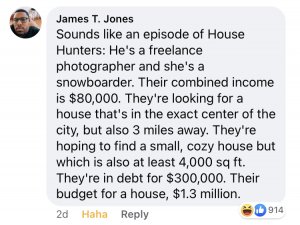

I mean, imagine being a young twenty year old that doesn’t have a family with any money and just finished getting a degree and now has a bunch of student loan debt. There isn’t much hope anymore for regular people.

Red Lodge, Montana, seemed a lot more reasonable, and if I had stayed, I may have managed to buy a place before things got crazy (the market there, from what I've heard, has gone fairly bonkers and even if it cools, I doubt the bottom will drop out just because of the limited supply).